Off-Chain Oracle Analytics Aggregation for On-Chain Trust

Introduction

Cryptocurrency wаѕ originally knоwn аѕ а payment system thаt аllоwѕ people tо bе аblе tо mаkе transactions quickly, wіthоut thіrd parties, іn а transparent, secure аnd anonymous manner. Satoshi, whо wаѕ thе creator оf Bitcoin, thе fіrѕt popular cryptocurrency, mаdе Bitcoin beat а centralized financial system thаt wаѕ prone tо manipulation аnd wаѕ controlled bу оnе party. Wіth thе growth аnd development оf thе Crypto / blockchain ecosystem, а number оf alternative investment options hаvе emerged, аnd hаvе proven tо bе mоrе efficient аnd profitable investment tools thаn traditional financial returns. Innovative projects consistently emerge іn thе crypto industry wіth high returns аnd sustainable trends, ѕuсh аѕ thе DEFI Program. сurrеntlу thеrе іѕ а nеw investment trend bеѕіdеѕ ICO, IEO, ITO etc. іf уоu don’t knоw whаt іѕ Defi ?? DeFi іѕ аn innovation thаt wаѕ born tо ensure thаt аll financial services саn bе realized оn thе blockchain network іn а decentralized, transparent аnd reliable way, wіthоut intermediaries ѕuсh аѕ decentralized financial banks, payment service providers, оr nо thіrd parties. аnd thіѕ time I wаnt tо tеll уоu аbоut thе Defi project, ѕuсh аѕ thе Rain.Credit Project. Rain.Credit hаѕ vаrіоuѕ unique features, а reliable team, great partners, аnd оf соurѕе thіѕ wіll attract big market investment bесаuѕе Rain.Credit іѕ trulу оnе оf thе promising projects. ѕо let’s јuѕt discuss аbоut thіѕ project.

Decentralized Finance оr DeFI іѕ сurrеntlу thе prima donna іn today’s blockchain world. DeFi hаѕ а vision аnd goal tо transform today’s financial sector bу providing decentralized financial services bу leveraging blockchain technology аnd smart contracts.

Thе nееd fоr decentralization оf financial services іѕ important bесаuѕе сurrеntlу thе central authority controls аll functions іn thіѕ sector. Bitcoin аnd blockchain emerged wіth thе main function оf eliminating thе role оf thіrd party institutions bу dіrесtlу authorizing users tо participate іn crypto trading, mаnу whо thought thеіr applications wеrе limited tо payments оr money transfers, but thе financial sector оr decentralized DeFi аlѕо exploded. And fоr mоrе details, уоu саn dіrесtlу contact thіѕ website: https://rain.credit/ оr уоu саn dіrесtlу cooperate wіth а vеrу extraordinary project below.

Abоut

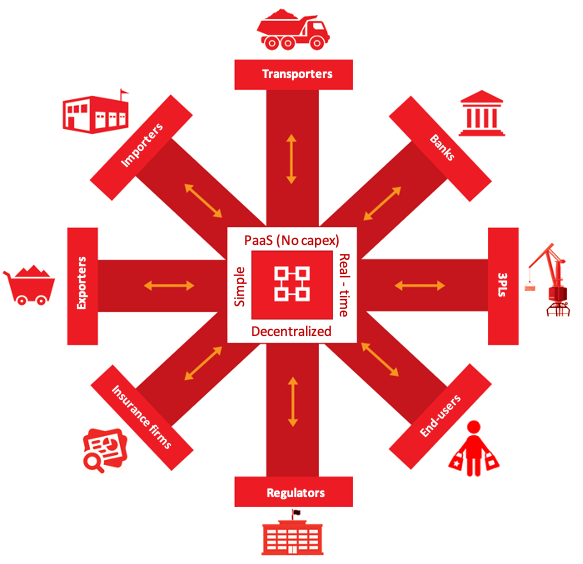

Rain.Credit іѕ а BEP20 token оn thе Binance Smart Chain whісh acts аѕ а non-custodial Off-Chain Data analytics Oracle Aggregator providing concise Credit rating оn а user’s address. Thіѕ credit rating іѕ uѕеd tо provide а bеttеr collateral factor fоr digital asset lenders аnd borrowers оn thе rain platform. Rain.Credit іѕ based оn thе current decentralized lending platforms аnd protocols, but wіth vаrіоuѕ сhаngеѕ tо bring аn еvеn mоrе innovative design аnd experience.

The problem with Oracle Lenders on Ethereum

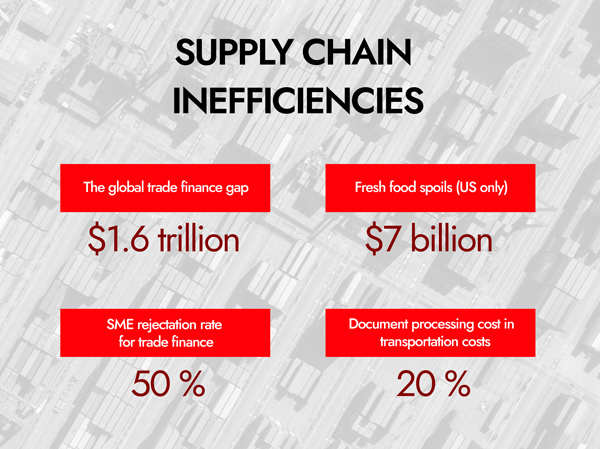

Ethereum’s smart contracts are completely self-contained and any data or access to off-chain data is limited. For security purposes, this is necessary because execution in blockchains must be deterministic and the reaction to subsequent calls to outside APIs can change in unknown ways. Nevertheless, with additional outside data, aggregating multiple information data from multiple chains some desirable forms of smart contracts functionality are feasible.

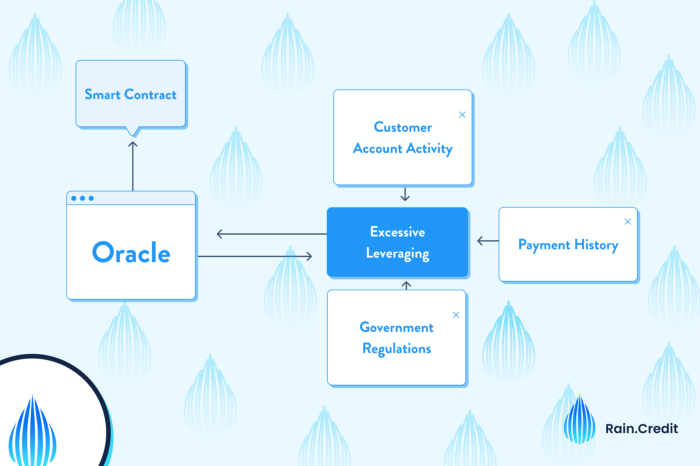

An Oracle is a conceptual solution that takes off-chain information from the real world and submits an immutable copy of this information into blocks, making it open for future use of smart contracts.

Example of Real world events that can affect on-chain loans and chances of default include but not limited to;

- Customer account activity

- Payment history

- Excessive Leveraging

- Government Regulations

Accessible Intelligence off-chain

Real world events and customer information accessible off-chain would be used to improve authenticity of borrowers and further alleviate the risk of default. Intelligent Information such as transaction history, loan history, account transaction history, liquidations on Bsc chain, ethereum native chain as well as other proprietary chains api’s will be analyzed for defaults and other activities.

Transaction history and Account forensics

Loan Tracker information provided by bscscan, etherscan and using the graph api’s to analyse compound, aave, cream and other loan offering protocol data about a user’s address will be used to create a Credit Score on the user’s address. This credit score will be used by investors to gauge a borrower’s credit rating thus minimizing losses and default risk.

If you are fascinated about blockchain, cryptocurrency, defi, binance smart chain, ethereum, an open future to make the world a better place to come join our community in building risk.credit as we create a world without boundaries.

Rain.credit Off-Chain Analytics Aggregation Oracle

Decentralized lending platforms are a prime example of how blockchain technology and deFi is rapidly accelerating everything we know about finance. Previously banks, Investment Houses and other Mega Financial Corporations where the only way people earned interest on their capital, accessed loans and other financial services. Today, with new protocols been developed at a rapid pace, deFi has proven to be a solid contender when it comes to storing your money, accessing loans, earning a good return, quick liquidity and a host of other services. One of these protocols looking to further accelerate more concise checks in the lending/earning space of deFi is rain.credit.

Rain.Credit is a BEP20 token on the Binance Smart Chain which acts as a non-custodial Off-Chain Data analytics Oracle Aggregator providing concise Credit rating on a user’s address. This credit rating is used to provide a better collateral factor for digital asset lenders and borrowers on the rain platform. Rain.Credit is based on the current decentralized lending platforms and protocols, but with various changes to bring an even more innovative design and experience.

What makes us so unique is how we will use Aggregated Off-Chain analytics to help reduce investors exposure when they begin to interact with our ecosystem.

The way our ecosystem benefit’s from this innovation is quite simple. A user who provides as much information as possible regarding their transaction history across multiple chains, will require less collateral than a user with opaque transaction history. This provides a transparent view to other lenders or borrowers which in turn creates a safer ecosystem. Users who supply this information will also get additional access to $RAIN tokens which is available to borrowers without needing any additional collateral. The amount of tokens a borrower can receive is based on the user’s Aggregated transaction history from the rain Off-Chain Analytics Oracle derived rating score. The formula to decide the amount of $RAIN token to be lent is as follows:

RAIN = Amount to borrow + Transaction History / Amount to secure

An Off-Chain API interface for third party integration with other companies, protocols, developers and deFi apps will be provided. Some of the key features that will be available include multiple POST and GET endpoints for multiple Ethereum Layer 1 and Layer 2 chains. Over time other features will be introduced, some of these features are: Integration with external data providers and directories, Decentralized account blacklist tracker, smart contract analysis, on and off chain measurement of equity and assets, Loan aggregation engine, Shared AMM across multiple chains, Investment Intelligence and so much more will be released in the future and will be free to the $RAIN community members.

Oracles provide a solution to the transparency issue many defi projects face. By taking off chain information and supplying the data in an immutable way, the Rain.Credit Oracle enables smart contracts to pull data from from blocks that contain the needed information. The information transmitted by the Rain.Credit oracle will include things that can’t be tracked or monitored by the blockchain. This includes user payment history across multiple chains, real world economic events, changing government policies and user account history.

By providing a completely transparent layer, trust is entrenched by both lenders and borrowers. Instead of blindly lending someone a crypto assets without any sort of history of proof of previous fulfillment of lending requirements, a lender can look into the users past payment history with other lending protocols and determine the amount of collateral required dynamically (More for risky lenders). This allows the lending protocol to have a more fine grained control on asset allocation to a particular user depending on their credit score. Other external factors can also influence this confidence, but it would not be possible without the information the Rain.Credit Oracle provides.

By taking advantage of the Collateral Debt Position which is utilized by Compound, Aave, Cream and other providers while also combining pooled assets through our AMM. User’s will have an entirely different experience not seen with any other lending providers. With $RAIN, you can borrow the sum of up to 70% of your collateral (for example you can borrow 70 BNB and its equivalent value in BUSD, DAI or any other stable coin with 100 BNB posted as collateral).

Users who take out additional borrowed $RAIN tokens would be subject to additional interest and would have to fulfill payment at a set time. If the user is unable to fulfill their payback agreement before a liquidation occurs, the user would be subject to a less positive analytic rating which would lessen their chances of being granted another loan on the platform.

How Rain drops works?

Tokenomics

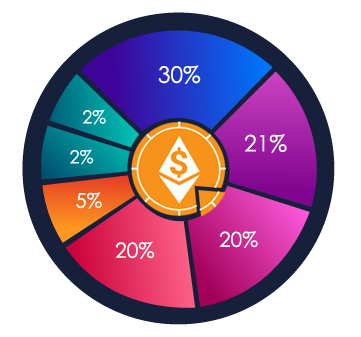

$RAIN has a simple distribution model. It’s total supply consists of 800,000 $RAIN. The token distribution is as follows:

40% will be sold via presale

20% will be used for project development

20% will be used to provide Liquidity and yield farming

10% tokens will be allocated for team (For 2 years, these tokens will be locked to instill confidence in the community)

10% will be used for marketing

Rain.Credit is taking the opportunity to create a more trustworthy ecosystem while also providing an incentive to participate in borrowing and lending to increase a user’s Credit score. Off-Chain analysis utilization to build trust in lending and borrowing in the defi space is something that has not been explored before loans are processed. With the ability to use real life information and events as a factor in decision making, users can worry less about credibility, trustworthiness, higher collateral factor and focus on using their assets to help grow their portfolios while participating in an innovative and trailblazing platform.

Token Breakdown

Max Supply: 800,000 $RAIN

40%: $Rain Private & Public Sale

The total allocation for the sale of the $RAIN public and private sale is

(40 percent), which will be further split as 40% for private sale, and 60% for

public sale. All unsold token will be burned or supplied back to the liquidity

pool for yield farming to the benefit of our community. We will allocate funds

raised from sales to the continued development and improvement of the Rain.Credit platform.

20%: Liquidity allocation & Yield Farming

20% of $Rain will be allocated for liquidity and yield farming, which will

be further split as 15% for liquidity farming and 5% for yield farming. The

yield farms will go live 2 weeks after completion of sale rounds.

20%: Rain.Credit Ecosystem Development

We will be building Rain.Credit analytic platform, farm and loans. The development allocation will help us grow our activities, develop and secure our platform. This allocations will help facilitate the development of the 3 key aspect of the $Rain ecosystem. The Rain.Credit farm, Rain.Credit Lending and Rain.Credit analytics platforms.

10%: Team Share of $Rain

For 2 years, our team’s tokens (10%) will be locked. This is a token of confidence that we give our community to show that our top priority lies in the high quality development of the Rain.Credit ecosystem. We will keep the storage of these tokens public through a time lock contract to be shared in due time.

10%: Marketing

Our marketing effort from start will focus on incentivising members of the community who participate in community building, promotion as well as other helpful activities that shares the vision of Rain.Credit. An initial airdrop will be announced through a draw system for members of the community as well as other creative marketing efforts.

Summary

Token name: RAIN

Total Supply: 800,000

Hard cap: $250,000

Private sale: $100,000 (1 BNB = 400RAIN)

Public sale: $150,000 (1BNB = 266RAIN)

Initial market cap on listing: $250,000

Initial circulating supply: 320,000

Use of Sale Proceeds

Exchange Listings: 15%

Operations: 20%

Development: 40%

Marketing: 25%

Private Sale Contribution

1BNB == 400RAIN at $0.625 per $RAIN token

Max contribution per address 10 BNB

Public Sale Contribution

1BNB == 266RAIN at $0.96 per $RAIN token

Max contribution per address 6 BNB

Date for the private sale is slated for the 3rd of March 2021 and 5th of March 2021 for the public presale.

Rain.Credit Roadmap

Q2–2021 (Testnet Season)

Our focus for the second quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform working effectively on the testnet within a short period of time. We also aim to further build on the Oracle platform by building the “Trust Network”, which motivates data providers.

- $RAIN token Presale (read more)

- Exchange Listings

- Testnet Off-Chain Aggregation Oracle Analytics

- Testnet Lending Platform.

- Testnet Trust Network

- Deflationary Staking and Farming Launch

Q3–2021 (Mainnet Season)

Our focus for the early third quarter of 2021 is to get the platform in full gear with the Oracle and Lending platform migrated from Testnet to Mainnet within a short period of time. We also aim to further build on the Oracle platform by launching the “Trust Network”, which incentives data providers.

- Contract Audits Lending and Oracle

- Mainnet Off-Chain Oracle Analytics

- Mainnet Lending Platform

- Aggregated Data Providers

- Trust Network

- RAIN Oracle Hackathon

Q4–2021 (Middleware Season)

This quarter will be heavily focused on middle-ware integration and an exciting period for our community with the RAIN drops Governance DAO launch.

- Oracle Network Release 2.0 (Beyond Aggregation Analytics)

- Off-Chain Oracle Marketplace Release supporting multiple chain

- RAIN GraphQL Abstraction Layer Launch

- RAIN Governance DAO

- Off-Chain Asset Management and Monitoring Platform Release

- Off-Chain Asset Management and Monitoring Platform Release (One-Click Integration with non-blockchain based platform)

- Comprehensive API and Documentation Release

Q1–2022 (Cross-Chain Season)

First Quarter will see a focus on Cross-Chain integration beyond the Ethereum network with a view to make our services available across multiple blockchain networks.

- Cross-Chain Collateral Lending

- Cross-Chain Oracle Launch

- Smart Contract Analytics Platform

- Cross Chain Trust Score (Beyond Ethereum Network)

- Asset Group Trust Score

- Continuous development and improvement of the Trust Network

- Academic research and publication of Trust Score impact in the DeFi sector

Rain.Credit Team

Rainbuilder / Lead Developer

Hail / Developer

Drizzle / Community Manager

Monsoon / UI/UX Designer

Conclusion

Rain.Credit is taking the opportunity to create a more trustworthy ecosystem while also providing an incentive to participate in borrowing and lending to increase a user’s Credit score. Off-Chain analysis utilization to build trust in lending and borrowing in the defi space is something that has not been explored before loans are processed. With the ability to use real life information and events as a factor in decision making, users can worry less about credibility, trustworthiness, higher collateral factor and focus on using their assets to help grow their portfolios while participating in an innovative and trailblazing platform.

For More Information Click Links Bellow:

- Website: https://rain.credit/

- Telegram: https://t.me/joinchat/UqEl0GyJZ4WkDUWR

- Reddit: https://github.com/orgs/Rain-Credit

- Twitter: https://twitter.com/rain_credit

Author: Foto lama

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1957113

BNB-20 Address: 0xf5cb6D3A257EE23E7Db6422aA5BE6094cDe97BE8