Bringing Collectables into the Digital World

Problem

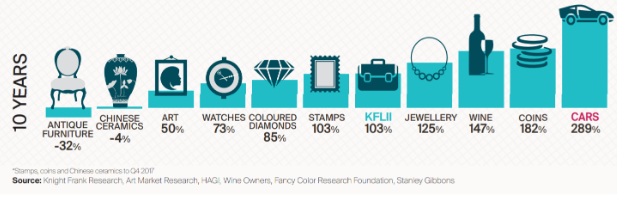

According to the Knight Frank Luxury Investment Index, over the 10-year period up to Q2 2018, collectable vehicles offered a return on investment of 289%. The asset class outperformed all other alternative investments under review over this period, including coins (182%), wine (147%), jewelry (125%), and watches (73%).

Despite the size and attractiveness of this asset class, only a small group of elite investors have had the resources necessary to overcome the barriers to entry to the market:

1) Restricted access: Many collectable cars are not sold on the open market. Limited edition collectable vehicles are manufactured in such small numbers that limitations are placed on who can purchase them. To be eligible to purchase such a vehicle, prospective buyers usually need to demonstrate that they have owned multiple other vehicles of the same brand. In addition, membership of an owner’s club or vintage fan group may be a prerequisite for purchase.

2) High capital requirement: the most valuable and lucrative collectable cars have high initial purchase prices. Once purchased, the vehicle needs to be insured, stored and maintained, incurring additional costs before a profit can be realized. While economies of scale could play a role in reducing such costs, they are rarely leveraged in the industry at present.

3) Expertise: Assessing the provenance and value of a car requires specialist knowledge. This is particularly important when a car is bought on the secondary market, as the vehicle needs to be inspected by an expert mechanic and all documentation needs to be verified.

The barriers discussed above preclude the majority of investors and car enthusiasts from participating in the collectable car market. Even for wealthy investors, however, the current market features high transaction costs and limited options for diversification:

4) High transaction costs: Transaction costs are driven by two main factors – non-transparency and illiquidity. For each vehicle, prospective buyers need to conduct a costly due diligence process in order to verify the provenance of the car. The lack of transparency in the existing market erodes trust, meaning that documentation needs to be independently verified. In addition, collectable cars are often sold at auctions or through private sales, which makes it difficult to accurately ascertain the current market value of a vehicle. Ultimately, this leads to an opaque, illiquid market, hurting both buyer and seller.

5) Limited diversification: A collectable car has to be purchased outright, which is in stark contrast to most other asset classes where fractional ownership is possible. Even relatively affluent investors cannot afford to own many collectable vehicles, and are thus exposed to greater risk due to the low degree of diversification.

Vision

CurioInvest Invest’s vision is to enable everyone to invest in and profit from collectable cars. By tokenizing investment-grade vehicles, CurioInvest will open up the collectable car market to thousands of new investors.

The CurioInvest team has a proven track record of profitably trading investment-grade vehicles at Mercuria Helvetica AG and has partnered with Mechatronik GmbH to provide the expertise necessary to store and maintain the vehicles. Such partnerships will enable CurioInvest to manage the entire life cycle of the investment in a cost-effective manner and to leverage economies of scale.

CurioInvest’s goal is to become the world’s leading platform for the purchase and trade of collectable security tokens.

Why CurioInvest?

CurioInvest is well positioned for the following reasons:

- CurioInvest is not starting from scratch. CurioInvest’s sister company Mercuria Helvetica AG has developed lasting relationships with many top-tier automotive companies including Pagani, Ferrari and Mercedes-Benz. Thus, CurioInvest has access to a pipeline of over 500 rare, collectable vehicles, ensuring exclusive investment opportunities from day one.

- CurioInvest has developed a tried-and-tested operational model to manage the entire life cycle of an automotive investment. CurioInvest has established contacts with car maintenance companies, insurance companies and tax-free physical storage providers.

- CurioInvest has established legal entities in Switzerland and Lichtenstein. Switzerland offers a stable regulatory environment and investor-friendly laws, while the base in Lichtenstein allows CurioInvest to legally sell security tokens throughout the European Economic Area, which comprises all 28 member states of the EU and the three EEA EFTA states Norway, Iceland and Lichtenstein. Switzerland has become a global hub of blockchain innovation, ensuring that CurioInvest will have direct access to the right technical talent to scale the business.

- The CurioInvest team and its partners consist of experts with a proven track record in the automotive, IT, financial and investment industries.

How it works?

CurioInvest aggregates individual demand through its Liechtenstein-based tokenization structure which issues tokens directly link into the underlying target collectable car.

Step 1 – Become a verified user

- register with your email address

- complete a sign-up form

- verify your identity

Step 2 – Invest

- Invest with others in a collectable car by joining the crowdfunding campaign.

- Receive a certificate confirming your investment in the car.

- As soon as sufficient funds have been raised, Curio purchases the car.

- Next, Car Tokens are generated and distributed to the investors which replace the certificate.

Step 3 – Monitor and Diversify

- Trade your tokens peer to peer.

- Track the performance of your vehicles.

- Buy new tokens to build up your garage and diversify your investment.

Investing through traditional institutions is difficult and can take several weeks. CurioInvest has digitalised the process so that you can invest wtihin minutes while complying with regulations.

Invest in minutes

Using your email address, create a free CurioInvest account to access current fine automobile offerings. Simply choose a fine automobile and decide how much to invest. You can build a portfolio to suit your own criteria and easily diversify across different brands. 0% fee to invest. (Depending upon your payment method additional fees may be added) (bottom view fine collectable automobiles)

Build your garage

Complete your Investors Profile and build your own collection of fine cars. 80% of profits will be paid back at you when car sells later at an auction, after covering storage, maintenance and insurance costs. (bottom “view fine automobiles)

Track investments

Keep an overview on how your investments are performing. All our cars are traded across diverse digital exchanges daily. Your dashboard allows you to review how much your token investment has traded in volume along with any capital gains or losses.

Sell your token investments

Past performance is not a reliable indicator of future performance. Selling is simple. List your tokens for sale to other investors at any time on diverse digital exchanges. Or else wait for the fine automobile’s 5 yearly exit circle where investors have the opportunity to exit at a market value.

Investing in fine automobiles was a headache. Not anymore. A team of experts research and source rare, investment-grade collectable cars. We only select competitively priced cars which have the potential to increase in value over time. All the key information about the vehicles is available on the CurioInvest platform (including the vehicle’s ownership history, the current market prices for comparable vehicles, and relevant media such as videos and photos).

- Finding fine automobiles

- Negotiating the deal

- Paperwork

- Maintenance and Repairs

- Revaluations

- Selling

Gain Access, Reduce Minimums, Build Your Portfolio

The fine vehicles on CurioInvest have represented consistently among the highest performing alternative asset classes, but up until now, the market was only viable for elite investors. Historically, access to collectable automobiles was exclusive to the elite investors committing more than $10,000,000 per asset or $500k per fond. By allocating 25% and more to alternative assets, this exclusive group boosted their portfolio returns over decades.

Roadmap

Jul 18

CurioInvest Capital AG incorporated in Zug, Switzerland

Oct 18

CurioInvest AG incorporated in Liechtenstein, Vaduz

Nov 18

Platform tech ready, regulatory draft confirmation

June 19

CurioInvest Launch Pad Game Offering

The public Sale of CurioInvest Tokens is planned for 2Q 2019.

After CurioInvest Game becomes available, global users would be able to register in waiting list to be the first to participate when security token platform is available

July 19

Prospectus draft ready compatible with DLT

Aug 19

Inaugural Issuance STO Ferrari F12tdf Sale

Feb 2020

CurioInvest may collaborate with other entities by launching a DAICO to offer all or some services in a fully tested and decentralized environment

Aug 21

New Financial Products Issuance

Explore potential benefits of Ferrari Index, Porsche Index.

Core Team

Fernando Verboonen – Founder & CEO

Valerie Halter – Co-Founder & CEO

Jan Van den Broeck MA – Legal & Compliance

Vladimir Kislinkskii MSc – Chief Technology Officer

CurioInvest’s Advisory Board

Tom Frey

Matthias Niedermüller PhD

Harald Steiger

Frank Rickert

Antoine Verdon, MSc

Boris Paskalev, MIT

CurioInvest’s Partners

Mechatronik Fahrzeug AG

Mechatronik are experts when it comes to the maintenance, storage and restoration of collectable vehicles.

Mercuria Helvetica

Mercuria Helvetica advises clients on how to strategically invest in vehicles. The firm also provides a wide range of services in the premium vehicle sector.

RABAG

RABAG is a company specialized in the storage of collectable vehicles.

For More Information Click Link Bellow:

- Website: https://curioinvest.com/

- Whitepaper: https://docs.google.com/document/d/16RBxiuPNhG7DkvTx9odzcQvPc9EdTKnmKaohURxrLTA/edit?usp=sharing

- ANN Thread: https://bitcointalk.org/index.php?topic=5175820

- Telegram: https://t.me/curiocarQA

- Facebook: https://www.facebook.com/Curioinvest/

Author: Foto lama

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1957113

ETH Address: 0x2092462b5cC6A670176Aa3F2D0215b8bda47b5a7

Tidak ada komentar:

Posting Komentar