Own Your Future P2P Lending Platform

About

FinWhaleX is a P2P credit lending platform that provides access to loans anywhere and anytime. Let’s take a look at how this works. In order to apply for a loan, the borrower must first set the parameters for the loan. These include the amount, interest rate, loan term, etc. Sometimes the company recommends evaluating the parameters of other applications in order to more easily navigate the process and select the most advantageous offers. In addition, there are options for choosing an application for a loan on bail. Two ways can be offered for this. First, you can place an application for secured lending. This method is more attractive. Second, you can transfer the required amount of collateral after the lender accepts the application. The commission for filing a loan application is 0.5% of the amount depending on the loan term.

How it works?

You Place a Loan Application

When creating your loan application, the Borrower set the parameters at its choice (amount, interest rate, period, etc.). We recommend evaluating the parameters of other applications already placed on FinWhaleX – lenders choose the most profitable applications for themselves. You can choose when to secure a loan application with collateral. There are two available ways. On the one hand, you can place the collateralized loan application which is more attractive for creditors. On the other hand, you can transfer the necessary amount of the collateral after the lender accepts your application. When placing the loan application, you need to pay a transaction fee in amount of 0.5% of the loan amount depending on the loan period.

Lender Accepts Your Loan Application

All creditors guarantee to fulfill their obligations for the accepted applications. After the lender accepts the application, FinWhaleX will generate a special multisig-address where your collateral (bitcoins) will be stored until the end of the loan period. Each party owns only one Private key for the multisig-address. Multisignature (multisig) refers to requiring more than one Private key to authorize a Bitcoin transaction. It guarantees that no one is able to access the collateral owning just one Private key.

You Return The Money Within The Term of The Loan

After repayment of the loan, you automatically return the deposit to yourself. No one can use your bitcoins until the loan is repaid – they are frozen in a special wallet. You can not return the loan, if it is not profitable for you. If the rate of bitcoin has not risen or fell, then you can refuse to repay the loan. In this case, the collateral simply goes to the lender, and your loan obligations are repaid.

Token Info

Token name: FinWhaleX

Symbol: FWX

Type: ERC20

Platform: Ethereum

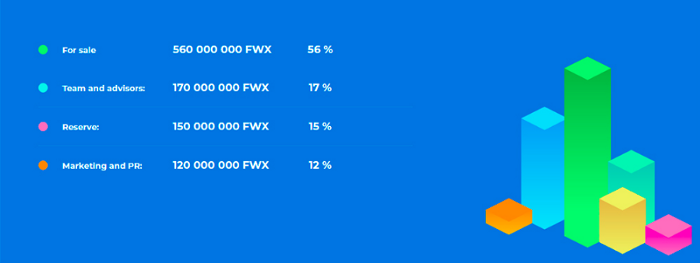

Token Distribution

56% for sales

17% for teams and advisors

15% reserve

12% Marketing and PR

Token Distribution

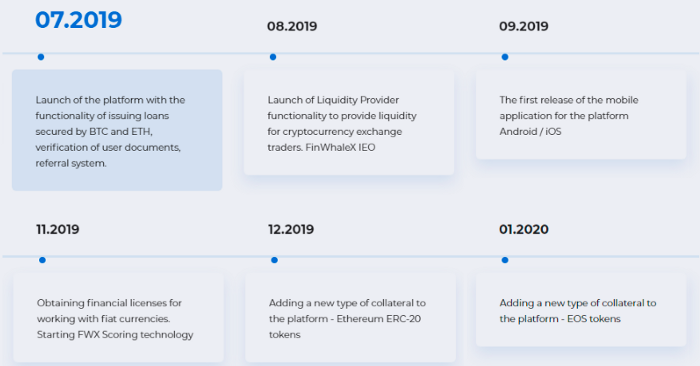

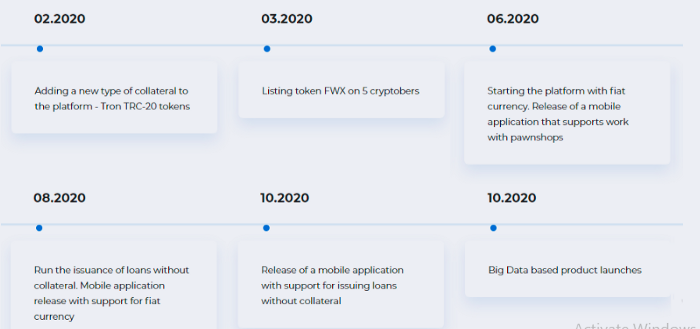

Roadmap

For More Information Click Link Bellow:

- Website: https://finwhalex.com/

- Telegram: https://t.me/finwhalex

- Facebook: https://www.facebook.com/FinWhaleX/

- Twitter: https://twitter.com/FinWhaleX/

Author: Foto lama

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1957113

Tidak ada komentar:

Posting Komentar